Cost Overruns and Sports Venue Construction

Introduction

As part of the research undertaken in Cape Town City, the authors, Damian James and Christiaan Bredenkamp considered ‘Cost Overruns and Sports Venue Construction’ by Martin J Greenberg and Dan MacMillan.

We were grateful to speak with Martin J Greenberg and his knowledge and application was exceptional.

The paper examines causes and reasons for the increased costs of stadia in the USA. It offers a high level comparable against other international stadia. Greenberg and MacMillan draw on studies by an International Association of Engineering Insurers (IMIA) Working Group in 2016. They also refer to the work Barry LePatner in his examination of mass inflation in the Stadia sector.

The examination is focused on the cost of the total project and does not solely concentrate on the construction costs. However, it does provide insight into the level of increases experienced in the construction costs on a percentage basis.

The Structure of the Analysis

Greenberg and MacMillan have structured their report in the following manner:

I. Introduction

II. Case Study of the harmful effects of poorly allocated cost overruns: Cincinnati Bengals

III. Budget Overruns are commonplace

IV. Sample Provisions

The use of language

The language used by Greenberg and MacMillan is not unusual to the English or South African reader. Although the use of some terms like ‘schedule’ are not used locally, they are understandable.

Evaluation of materials included in the analysis

The material included in the report is plentiful. In some cases, it is founded on academic research. There is a large collection of reference documents provided by way of footnotes. It appears the referenced documents are provided by other researchers or publicly available materials from analysis completed on other stadia.

Of significance is that the paper appears to be the first of at least two referring to stage 2 analysis. It also makes reference to Greenberg and MacMillan’s previous paper ‘The Windmill Clause.’ There is a great deal of logical thinking and rational application used in the paper.

Summary of the Analysis

The paper alludes to cost overruns being a natural part of construction projects, not strictly unique to sports stadia. It also suggests that costs in stadia will or can continue to overrun. It fails to recognise the large number of stadia that have been built to budget. It also fails to note well-known projects where unique forms of commercial management have seen budgets met by team innovation and guaranteed maximum price agreements.

The paper discusses the causes of overruns. It cites failures in the allocation of responsibility, the increase in costs brought about by unforeseen issues. It also discusses the costs incurred due to unavoidable changes.

In referring to the 2016 International Association of Engineering Insurers Working Group (IMIA), the paper lists the following items as the root causes of stadia cost overruns:

· Ineffective project governance, management and oversight

· Unanticipated site conditions

· Poor project definition

· A poor identification of risk, management and response strategy

· Imposed cash constraints and delayed payment

· Skilled labour availability

· Inexperienced management team

· Design errors and omissions leading to scope growth and/or re-work

· Poor project controls (cost and schedule)

· Inaccurate estimating

The very identification of these items is not a new phenomenon to those who work in construction projects. These are of course and as described by the IMIA, the root causes of cost overruns in all construction contracts.

Nooran

Reference is made to the thesis of Moiz Nooran, ‘Mitigation measures for controlling time and cost overrun factors.’

Nooran introduces a long series of factors and causes of overruns. Upon closer inspection, these do not differ greatly from those that the regular construction manager is aware of. It would be fair to say that Nooran introduces nothing new. The paper does not provide anything definitively spectacular to stadia overruns, beyond issues found in regular construction projects.

The paper provides an overview of over-budget construction projects in comparison but does not provide an examination of the reasons for the overrun. A matrix approach to the root causes, drawing similarities and comparing the effects thereof may have assisted the writers here rather than the insertion of numbers without critique.

The paper is however helpful in its discussions of particular US stadia. While not directly comparable with stadia in Africa does highlight the issues experienced by the USA in constructing stadia.

The paper then moves to a focus on overall development costs and makes continued reference to public funding and the resultant drain on the taxpayers in financing stadia, particularly those in a cost-haemorrhaging situation.

Political and Societal Impacts

It is appropriate that comment is made on the position of politicians and communities who become angered and upset by the growing reliance on the local taxpayer to fund overruns.

This is of relevance to the position of Cape Town City which found itself being the victim of price rigging. They have had to draw on existing funds and increase future recovery in order to finance a stadium that was, to all intents and purposes, priced higher than it ought to have been. The resultant anger is not unreasonable when one considers the veil of collusion which has brought about this situation.

The paper then references Mr Barry LePatner who discusses the ‘mass inflation’ of construction projects in the previous twenty years. LePatner then advises that the, ‘lowest bid is the most cost-effective’ principle no longer rings true.

LePatner articulates many common causes of cost overrun and is helpful in his calculations. He suggests that price increases are in the region of 20-30% and are most commonly the result of fast-tracking projects through to meet fixed completion dates.

LePatner argues against the need for the completeness of design and the mitigation of change orders.

Fixed Completion Dates

The Cape Town stadium is no different and it is not unusual for stadium to have fixed dates for completion. I am of the view that fixed dates actually assist the management of cost and cost overruns. It would appear a fact-based position to state that fixed-date stadia are most likely to suffer bigger overruns and cost increases. This can be seen in the examples of Wembley Stadium, and more recently, White Hart Lane.

The paper provides that another albeit unnamed expert suggested that cost overruns are in the region of 15-25 %. Again we do not consider this an unreasonable assessment.

This form of assessment is, in general, in keeping with the Cape Town Stadium. There a fixed completion date saw cost overrun concluding at around 25%. The issue is not so much the cost overrun but the fact that the price was higher than it ought to be.

The excessive margin generated by price rigging did not provide funds to counter overruns. It simply generated greater margin for the balance sheet of the Contractor the contractor received additional monies from Cape Town City to pay for the overruns.

If in the instance, that Contractor had included a margin of 10%, then they would have maintained the 10%. They still would have received additional funds for the cost overruns, this is supported by the paper.

Who Bears the Cost?

The commonality in the two positions is that price increases are borne by the end user. In the USA this may result in higher concession or ticket costs. In Africa, it is unrealistic to increase the price of concessions and tickets to a level that is beyond the earnings of the ordinary man.

However, if recovery is not achieved, then the public must fund through higher taxes and over a longer period.

Cape Town City is responsible for the increased cost of 25% and is ultimately held liable for the management and design completed by its teams. The City has to secure these funds from the taxpayer. Recovery from the taxpayer of collusion costs and the additional margin generated by rigging the price submission cannot be the responsibility of the taxpayer, this is simply unfair. The taxpayer benefits from a world-class stadium and the overrun costs are part of this benefit. There is no benefit to be had by the taxpayer for, in effect, lining the balance sheet of the Contractor and it should not be expected to pay.

In Employer and Contractor overrun relationships, it is the Employer or the Contractor who bear the cost. In public projects, stadia, it is the taxpayer who pays. Often they pay twice, through increased concessions and ticket costs and by increased taxes.

Other Project Types and Scenarios

The use of taxation to finance cost overruns in projects is not limited to Stadia. It can be applied to infrastructure, medical and educational projects.

The concept of price rigging was an all-but-dead phenomenon in many jurisdictions. Unfortunately, it found a route through to the 2010 world cup stadia bids.

The common theme is the overall cost of stadia developments having specific regard to lease agreements, future developments and commercial strategies. Cape Town Stadium would be comparable if there had been a series of large-scale retail outlets included as part of the scheme as has been the case in many of the UK football league stadia. On examination, the case studies do consistently evince a construction overrun of between 15-25% and I take no exception to this percentage.

Other sources of research

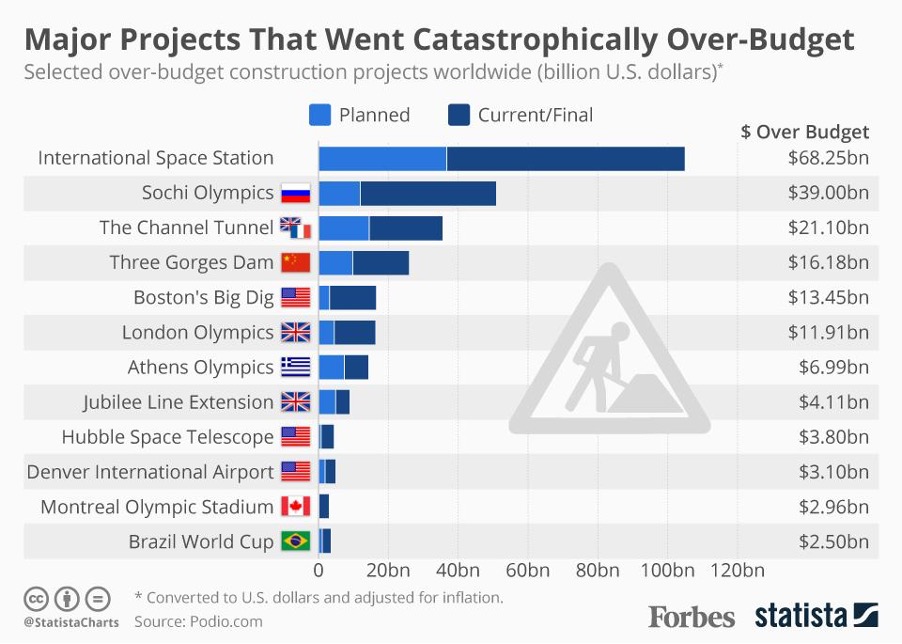

Major Construction Projects That Went Catastrophically Over-Budget [Infographic] by Neil McCarthy was published in Forbes in September 2018, text from the article follows:

‘The German stereotypes of efficiency and world-class engineering have been seriously dented in recent years by a series of highly embarrassing blunders regarding construction projects. Hamburg’s glittering Elbphilharmonie concert hall arrived six years late and €700 million over budget…

News emerged yesterday that Germany had beaten off competition from Turkey to host Euro 2024, Europe’s flagship international soccer tournament. Given the country’s recent record of disastrous public construction projects with the Leipzig City Tunnel and new Stuttgart train station notable additions to the ones mentioned above, it may come as a relief that the country doesn’t have to build new stadiums in order to host the event. Ten venues will be used for the competition and all but one of them were already used for the 2006 FIFA World Cup.

Disastrous Costs

The following infographic shows just how expensive disastrous projects can get, with sporting events particularly risky endeavours when it comes to keeping costs under control. Brazil had to build numerous venues and infrastructural projects when it hosted the FIFA World Cup and cost overruns for that event amounted to $2.5 billion, according to a list compiled by website Podio. The Olympics tend to go over budget far more frequently and drastically with Athens costing $7 billion more than planned, London needing an extra $11.9 billion and Sochi going a whopping $39 billion over-budget.

As dramatic and disastrous as that was, it pales in comparison with the planned and final price tag for the International Space Station. That project started off with a $36.75 billion budget and it was completed six years late with final cost of $105 billion – 186% over budget. China has embarked on a mammoth construction spree over the past three decades and it isn’t immune to catastrophic overruns either. Even though the Three Gorges Dam was completed three years ahead of schedule, it came in 163% over budget with a final cost of $25.96 billion, a steep increase on its original budget of $9.85 billion.’

Final analysis

In the final analysis, project overruns depend on the location, the event and the surrounding and incumbent commercial obligations.

The sources of research do not detract from the Cape Town Stadium base build price. Critically, that what the price ought to have been does not arise in the paper and article referred.

The research does demonstrate what a very good job everybody did at Cape Town. They completed on time, with overruns generally in line with the considered percentages and disputes avoided. Credit must be given.

It is, however, a real shame that such a standout achievement which ought to be a test case for world stadia build is truly blighted by the scandal of the price rigging and unfortunately this will be the stadium’s legacy.