Preamble

This article examines the benefits, compexities and quantum calculations for a PFI project, the type of which is often found on African infrastructure projects. The article was originally written with the model of a desalination plant in mind, so some measurements used reflect that. The aim here is to examine some of the benefits of a PFI project using the BOOT (Build, Own, Operate, Transfer) procurement route. We also seek to identify some of the operational complexities and risks.

As Smit observes,

“Despite abundant natural resources, increasing exports, and receiving aid from donors, the African continent still needs to overcome numerous challenges. Africa needs to develop its manufacturing industry to improve its economic situation, which requires a reliable and sustainable electricity supply. One way to achieve this is to involve the private sector in constructing, operating, and maintaining the necessary electrical infrastructure through public-private partnerships (PPPs). Given the importance of Green Energy, the paper highlights the potential PPP hydroelectric project opportunities in Africa. It explores the benefits of PPPs, the reasons for their failures, and the critical factors contributing to their success.”[1]

Public Private Partnerships or Private Finance Initiatives (PFI) therefore exist on many projects across the African continent. Pioneered by the UK government in the early 90s, PFI has been seen as a useful way to make use of private sector expertise and remove capital costs from government budgets.

One of these PFI models is the Build, Own, Operate and Transfer Type projects (BOOT)[2]. These are used as an effective procurement vehicle globally and are seen in water management, sewage control and waste management projects. As well as a range of other infrastructure activities.

The narrative that follows describes how service providers (PPP) work when using the BOOT model and focuses on the details of risk allocation and price tariffs in water management projects.

Overview

A contract between a public body and one or more private sector companies is established in which the private party provides an asset (which in turn provides a public service) and assumes considerable financial, technical and operational risk in a project. The public body pays a fee for this service in either a single or two-part tariff.

The private company, referred to as the service provider, makes a significant capital investment. By borrowing from banks, financial institutions and or other investors, based on the strength of a contract with the public body to provide agreed services.

Service costs are paid for by the public body when the infrastructure is operating (i.e., a plant with availability to produce water) through a number of tariffs per applied measure[3].

The general consensus[4] is that there is a trend of moving towards this procurement route for public capital projects. It is deemed to increase private sector involvement whilst bringing quality and innovation. As a result, projects tend to be built quickly and operated efficiently, without the large capital cost of traditional procurement.

For public bodies controlled by audit and budget responsibility, this offers a manageable route to investment.

The Traditional Route

Conventionally, a public body or organisation (client) would follow a traditional procurement route.

They would appoint an engineering consultant, architect, or a complete professional team to design an infrastructure project and send it out to competitive tender to at least three (3) contractors.

Contractors would price the project, often during a lengthy tender period. They will give details of the materials, equipment, methods, manpower and program etc. The client then selects the preferred and compliant contractor (nearly always the cheapest) to supply, install, construct and commission the infrastructure. An engineer supervises the construction.

The finance is sourced by the client, who operates and maintains the plant for the life of the infrastructure.

The Move to the Boot Procurement Route

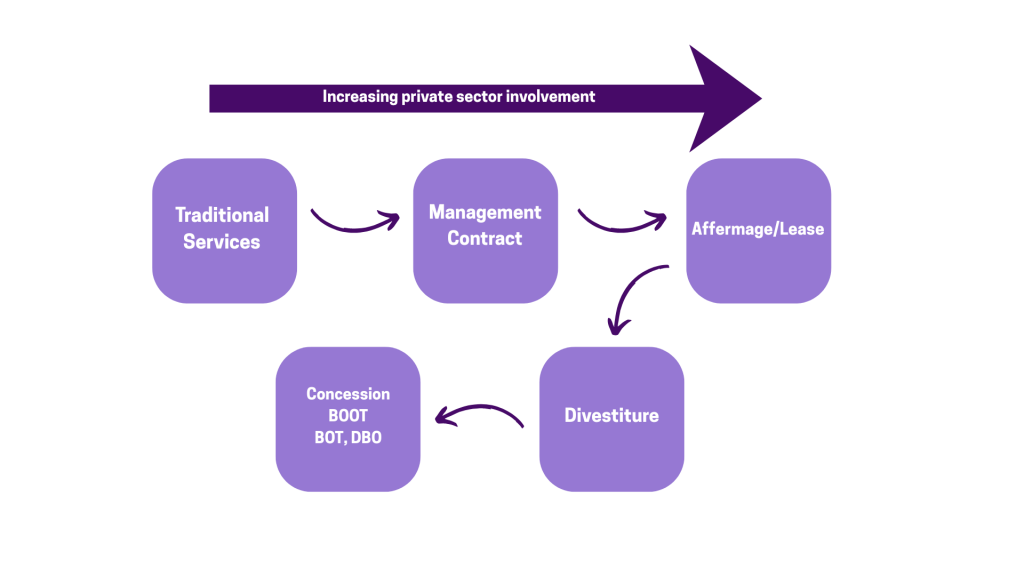

- In recent years, both globally and nationally, the progression from the traditional arrangement to project delivery methods (as per the diagram below) has seen increasing private sector involvement using procurement routes like management contract, a lease contract, a concession (DBO, BOT, BOOT etc), and complete divestiture.

There are many acronyms used to describe the same or a very similar thing; DBOO, BOO, DBOOT, BOOT. However, this form of procurement route is not the same as an EPC or a design and build contract. It must not be confused with either.

Typically, the service provider provides all capital/funding in a BOOT. It then owns and manages the assets until the agreement ends. At this point, the payment by the public body for the service is complete. The relationship between the service provider and the buyer of the output or the service is set out in the tender documents or a concession agreement.

In the context of Africa, the use of BOOT contracts is common. A cursory review of the World Bank’s[5] investment portfolio evidences a heavy focus on this improved form of procurement.

The transition in the procurement process segways with the transfer of risk from public bodies to the private sector. This will happen for an increasing fee, one which is relative to the risk, and with it brings a quality and innovative end product.

Risk Allocation

Typically, the allocation of risk between the parties comprises the public body and the private entity delivering the project. The private entity takes responsibility for feasibility and detailed design. It works through to completion of construction and operation and maintenance, as well as all financing. In contrast, the public body takes charge of land access and tasks outside the physical site boundary. These might include service diversions and pipelines up to the boundary interface points.

In the basic model, the process works where there is a fair distribution of risk. Agreements need to be of a ‘bankable’ basis.

The model still requires the calculation of capital and construction costs. This applies in the same way a traditional tender would, but more often the specialist nature of the project reduces the tender period. This is due to the limited number of private companies who have the relevant expertise and the product knowledge. The calculation will also include the interest attracted over the period of the lease.

The total cost (capital, cost and interest) is then divisible by the term, or the period of the lease. A repayment calculation can be made on a monthly, yearly or bi yearly basis. This cost calculation is the first part of the tariff. It becomes the tariff for the availability of the construct. In other words, it is the tariff for financing and constructing and having the plant available to supply.

The second cost element requires the service provider to calculate its cost-of-service provision. It then converts this cost into a tariff. The second part of the tariff is the operational aspect of the construct, for example, the production of the unit of water (the applied measure).

Roles of each party are mutually dependent. The public body is responsible for the purchase of the service or the output and for a guarantee of a certain purchase level.

Conversely, the service provider handles the project company (if required), the capital investment, the construction and providing the service or the output for its guarantee of certain performance levels.

Benefits of Boot Procurement

- Public bodies use BOOT type contracts for many reasons but typically these include:

Leverage of debt finance to complete more projects and improve infrastructure development in a quicker period of time.

- The transfer of risk to the private sector whilst gaining the benefit of private sector efficiencies in deliverables.

- The integration of the design, build, operation services increases and leads to improved innovation.

- Whole life costs and fiscal benefit of an “off balance sheet” accounting of the capital costs i.e. CAPEX.

- The private approach to delivery, including strict performance criteria, quality, standards and the quality of customer delivery.

Benefits to the public body are multiple and include:

- The freeing up of capital for other uses.

- The freeing up of resources for other uses.

- Allows the public body to focus on its core operations (not attempting to become specialist constructors in water treatment).

- A central hub for the purchase of all of the services.

- Negotiated and competitive prices.

- Dedicated service provider for a specific task.

Risk Allocation

The party who bears the risk is a product of the party in the best position to mitigate the risk.

In general, the service provider might be considered the best placed to bear risks but, where the service provider bears a risk it cannot mitigate. This would be reflected in an increase in the tariff (the more risk borne, the higher the tariff charged).

The service provider can take more risk. In that case, the public body would experience an increase in the tariff, reflecting a higher risk burden.

In considering the service provider’s requirements for financing there is a trade-off, or a divide, on the risk and reward scale.

For example, a risk may be considered too high and is not considered serviceable by a bank or finance institution. In that case the requirement for private equity may become apparent.

Generally, a project whose risk is considered too high for financial institutions and can only attract private equity, will probably be subject to higher tariffs.

The service provider is generally accepting of risks in areas of their own expertise. These will include design, construction, technology and controllable operations. However, the service provider will typically only accept limited risk in non-controllable operations and changes in legislation.

Tariff Options

In the following, we outline some of the complexities and considerations for the structuring of a tariff system for a BOOT project. Bear in mind again, that some of the measurements refer specifically to a desalination project:

- In general, the BOOT model will be serviced on either a two-part tariff or a levelized tariff. It is on this basis that service providers enter into the agreement.

- As noted earlier, the components of the tariffs consist of an ‘availability’ component and an ‘operating’ component.

- A levelized model is based on a single component which recovers the availability component and the operating component. This would generally be reflected by the agreement and administration of a rate per m3 being applied to the service provider’s minimum output.

- In the two-part tariff the two components are separated for the purpose of administration and agreement. The payment for the service will be constructed of a two-part tariff. This reflects the two differing parts of the service provision:

- The first part is availability, which reflects the capital investment in the service provision, the interest payments during its construct, the lease period and importantly, a return on the investment.

- The second part is the operating component, reflecting the recovery of the operating costs, maintenance costs, energy costs and the cost of consumables during the operating part of the service.

- The first part of the tariff is based on a fixed amount per month. This is generally a constant of the availability at which the construct is intended to perform.

- The second part of the tariff is based on the applied rate per m3. It is a function of the demand required by the public body.

- The single, or two-part tariff approaches are both necessary for contract agreement. They are dependent on the costs of the service provision and risk apportionment.

- The proper calculation of all costs to be incurred in the service provision concludes in the single or two-part tariff.

- In general, with service providers providing specific services such as wastewater treatment, desalination and sewage management, the capital investment required to meet availability will be calculable and included as the availability calculation of a two-part tariff.

- Thereafter, the service provider can determine the costs of the operating component to meet the demands for production.

- Generally, tariffs become fixed for the applied m3 per year or for the term of the service (when periods are short). However, it is important to account for all risk occurrences in some form in the contract. For example, these risks may include greater stringency being applied to the water or sewage standards requiring revision to the tariff structure.

The General Principles of Risk and Tariff

The principle to be considered in a BOOT contract where tariffs are driven as a product of risk apportionment, is that the service provider does not provide anything for free.

The more risk placed onto the service provider, then the higher the tariff.

If, in certain circumstances, the public body wishes to impose a new risk or an unexpected risk onto the service provider, then the tariff is adjusted.

In respect of the application of penalties imposed by the public body, the risk rationale applies. If penalties are too high and simply erode the investment return, the service provider will ordinarily reject their inclusion in an agreement.

A balanced approach to penalties is required. If applied correctly, it will equitably reflect the position of both parties in the penalty situations that may or may not arise.

To safeguard both parties, general common-sense principles apply, these include reasonable projections and the best apportionment of risk.

A further consideration when contemplating risk and tariff, is the financial institutions who may well decide that the risk to tariff ratio is insufficient to warrant financial support.

In general, it can be said that a project that is supported by a financial institution will have met the correct level of risk and tariff profile.

Critical Analysis

The demand for projects in Southern Africa and the procurement choice follows from heavy periods of droughts. Therefore municipalities must to have systems in place for disaster management.[6]

Contracts awarded for the “Design, Supply, Establish, Commission, Operate and later to Decommission a Sea Water Reverse Osmosis Plant at a site, to Supply SANS 241: 2015 Compliant Potable Water” are not uncommon in Southern Africa..

A financial offer may be described as follows:

| DESCRIPTION | RATE |

| D: Fixed Cost (Availability Cost) | R 1 462 641.83/month |

| H: Variable Cost (Operational & Maintenance costs and electricity costs) | R 9.59/m3 |

- The description of the contract in the tender documents required would be consistent with the BOOT procurement route with the essential terms, design, supply, establish and operate mirroring the BOOT process.

- The financial offer of the service provider, included in the Summary of Price Schedule, is consistent with the two-part tariff methodology, with the first part providing for the availability tariff and the second part the operational tariff.

- The first part of the tariff is a fixed cost per month and represents the availability tariff. When this is converted to the formula for tender evaluation purposes, the rate is calculated by reference to the “availability cost” of 60 000m3 (of water).

- The calculation of the two-part tariff can be best explained with regard to the Summary of the Price Schedule.

- In the Summary of Price Schedule, the following key observations are made: the figure included in sub-total 1 (fixed costs) is the summary of the total of schedules 1 to 4 (the build) and is denoted as A in the sum of R 30,463,528.34, this is the capital and construction cost of the plant.

- In the item noted as B is the tendered interest rate applicable to the fixed and variable costs i.e., item A, the capital and construction costs.

- The addition of interest over the period of 24 months is included in the sum to calculate the total capital, construction and interest costs, and is calculated as:

- A 30 463 528.34[7]

- B Interest added 14%[8]

- C Monthly interest is 1.166666% [not 1.666666% as noted][9]

Calculations:

The total cost is considered over the period of the lease. In this instance, a period of 24 months and the divisible payment per month is calculated as a function of A plus B divided by 24:

· D Payment 1 462 641.83

This equals a total payment of 35 103 403.93 when considered over 24 months[10]

The conversion of this fixed fee to a rate for the purpose of valuation comparison, uses the constant of 60 000m3, or the availability of the plant in a monthly cycle (this being calculated as 2000m3/2ml of water per day over a 30-day cycle). To calculate a rate for comparison purposes only and not for payment. The use of the comparison rate, when considering compliant tender bids, avoids the requirement to provide a detailed analysis of the component parts of the capital and construct costs. This is because such an approach would be similar to a traditional procurement route and would be time exhaustive.

The tender rate is then calculated by dividing the monthly rate by the availability and considered as follows:

- D Payment 1 462 641.83[11]

- Availability cost 60 000m3

- E Rate per m3 24.38

By way of example a tender rate provided by another tendering company of, for example, R 28.00 would be based on a capital and construct cost as follows:

- Rate per m3 28.00

- Availability 60 000m3 (multiply by 60 000)

- Payment 1 680 000.00

- 24 months (multiply by 24)

- A and B Cost 40 320 000.00

- A cost 35 368 421.06

- B cost 4 951 578.95

Two-Part Tariff

This would then allow an understanding of the comparable two-part tariff as follows:

| DESCRIPTION | RATE |

| D: Fixed Cost (Availability Cost) | R1680000.00/month |

| H: Variable Cost (Operational & Maintenance costs and electricity costs)Using the same rate as QFS[2] | R 9.59/m3 |

In the Summary of Price Schedule, the following further observations are made. The figure included in sub-total 2 sum (schedules 5 and 6) is the summary of the total of schedules 5 to 6 and is denoted as F[13]in the sum of R 11,983,872.00, this is the variable cost of the plant including operational and maintenance costs and the bulk electrical supply.

In the item noted as C is the tendered interest rate applicable to the variable costs i.e., item F, the variable costs.

The addition of interest over the period of 24 months is included in the sum to calculate the total variable and interest costs

The addition of interest over the period of 24 months is included in the sum to calculate the total variable and interest costs, this is calculated as:

The total amount payable is G multiplied by 24 months equalling a Total of 13 809 126.00

The total cost is then considered over the period of the lease. In this instance, a period of 24 months and the divisible payment per month is calculated as a function of F plus B divided by 24:

- 13 809 126.00 divided by 24 months

- G Payment 575 380.25

The variable rate is then calculated by dividing the monthly rate by the variable rate (availability) and considered as follows:

- G Payment 575 380.25

- H Variable cost per m3 (Availability cost) 60 000m3

- E Rate per m3 9.59

The variable cost per m3 is the rate used for the payment in the second part of the tariff.

Conclusion

The use of the BOOT procurement process generally relies on two-part tariff. The two-part tariff is widely promoted by the world bank. It is aimed at recovering costs and economic efficiency. It is particularly common in water management projects.

The first part of the tariff is commonly referred to as the availability component and corresponds to the fixed costs of production, administration and the availability of demand component.

The second part of the tariff is the operational component. This corresponds to the costs incurred in the operational phase of the component.

The procurement method in many desalination projects is consistent with a BOOT procurement process. The pricing method included in the pricing schedule was consistent with a two-part tariff. The two-part tariff is composed of item D and item H in the pricing schedule.

For tender evaluation, the first part of the tariff has been divided by the availability component of 60 000m3 to provide an evaluation rate per m3 (as item E of the Summary Price Schedule)

The use of the evaluation rate to consider tender bids on a high level for comparison purposes is consistent with this type of procurement process. The evaluation rate is not used for the purpose of the two-part tariff and the payment provisions.

If an evaluation rate was used for the purpose of a two-part tariff, it would produce an inconsistent and distorted valuation of the capital, construct and interest costs incurred by the service provider and would be rejected[SW1] [SW1] .

Bibiliography

Smit, J. “A Literature Review of Public-Private Partnerships’ Role in Energizing Africa and, in Turn, Activate the African Manufacturing Revolution and Enable Economic Upliftment” – Open Journal of Business and Management > Vol.13 No.3, May 2025

World Bank Tool kit (http://web.worldbank.org) evidences multiple contracts using bOOt across southern and northern Africa.

[1] Smit, 2025 at paragraph 1

[2] Operator models were developed for public-sector projects, where they are referred to as public-private partnerships (PPP). In these projects the plants are transferred into state ownership following the operational phase. In the mid-1990s they were also introduced in industrial sectors such as the automotive industry or tank terminal construction. The model is used in Africa, UK, Australia, the far east and includes water, waste and power management.

[3] Applied measure refers to the unit of availability and operation e.g. m3 or ml

[4] Amongst research into procurement processes for water and waste management see for example: https://www.financierworldwide.com/lessons-the-middle-east-can-learn-from-the-uks-pfi/pf2-model

[5] Website: World Bank Tool kit (http://web.worldbank.org) evidences multiple contracts using bOOt across southern and northern Africa.

[6] the declaration of the city of Cape Town in and other areas in the Western Cape as disaster zones, in terms of the Disaster Management Act 57 of 2002

[7] A is the total of schedules 1 to 4. Schedules 1 to 4 are provided in the price schedule for V&A Waterfront

[8] The monthly fixed payment is calculated by using the formula D=A*(C(1+C)24 / ((1+C)24 -1))

[9] The interest calculation correctly uses 1.166666% and not the 1.666666% included (interest is 14% annual divided by 12 months = 1.166666% monthly)

[10] 1 462 641.83 x 24 (months) = 35 103 403.93

[11] 1 462 641.83/60000 = R 24.38

[12] For the sake of clarity in the example given the same rate provided by QFS for the second part of the tariff is used

[13] F is the total of schedules 5 to 6. Schedules 5 to 6 are provided in the price schedule for V&A Waterfront

[14] The monthly fixed payment is calculated by using the formula G=F*(C(1+C)24 / ((1+C)24 -1))

[15] The interest calculation correctly uses 1.166666% and not the 1.666666% included (interest is 14% annual divided by 12 months = 1.166666% monthly)